COVID Induced POTS Or Nervous System Disorders

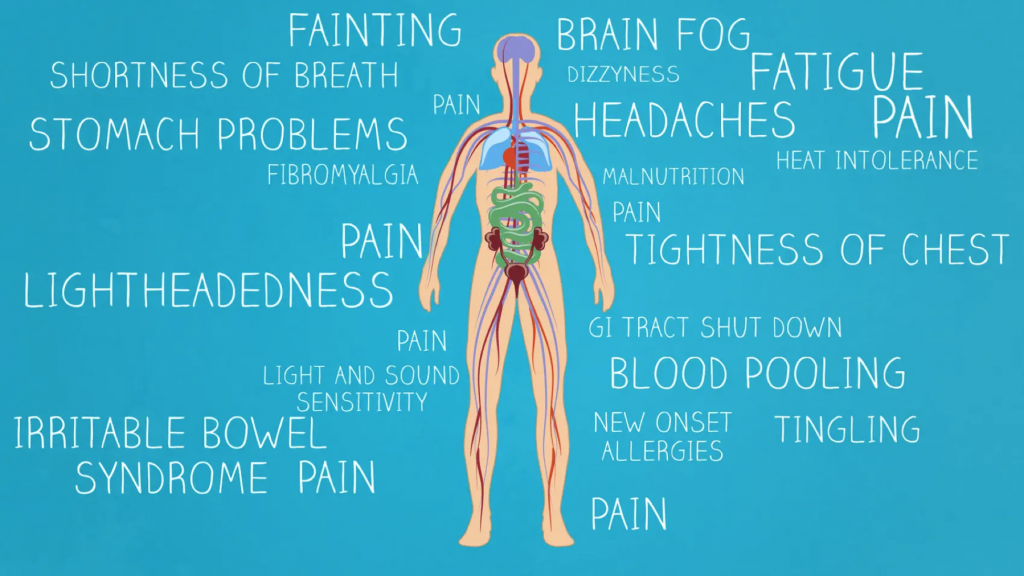

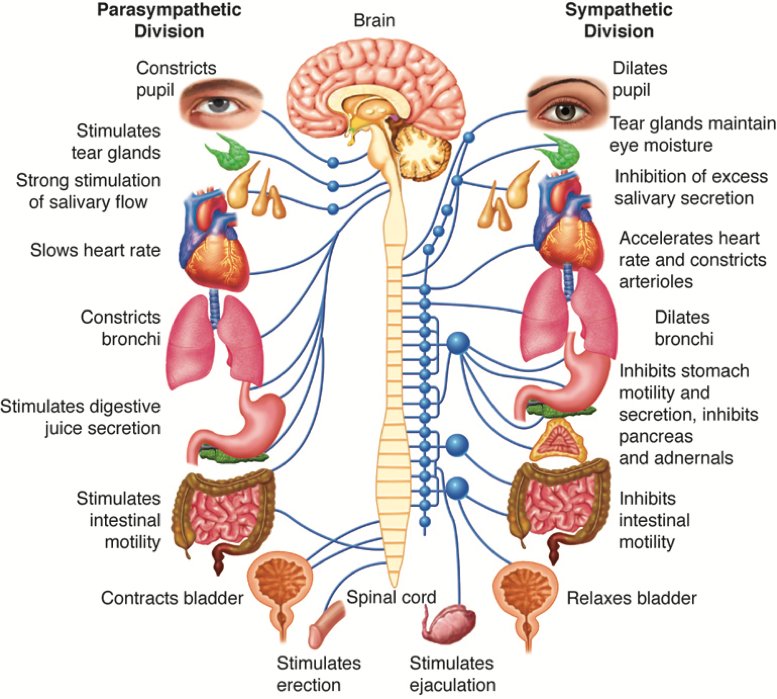

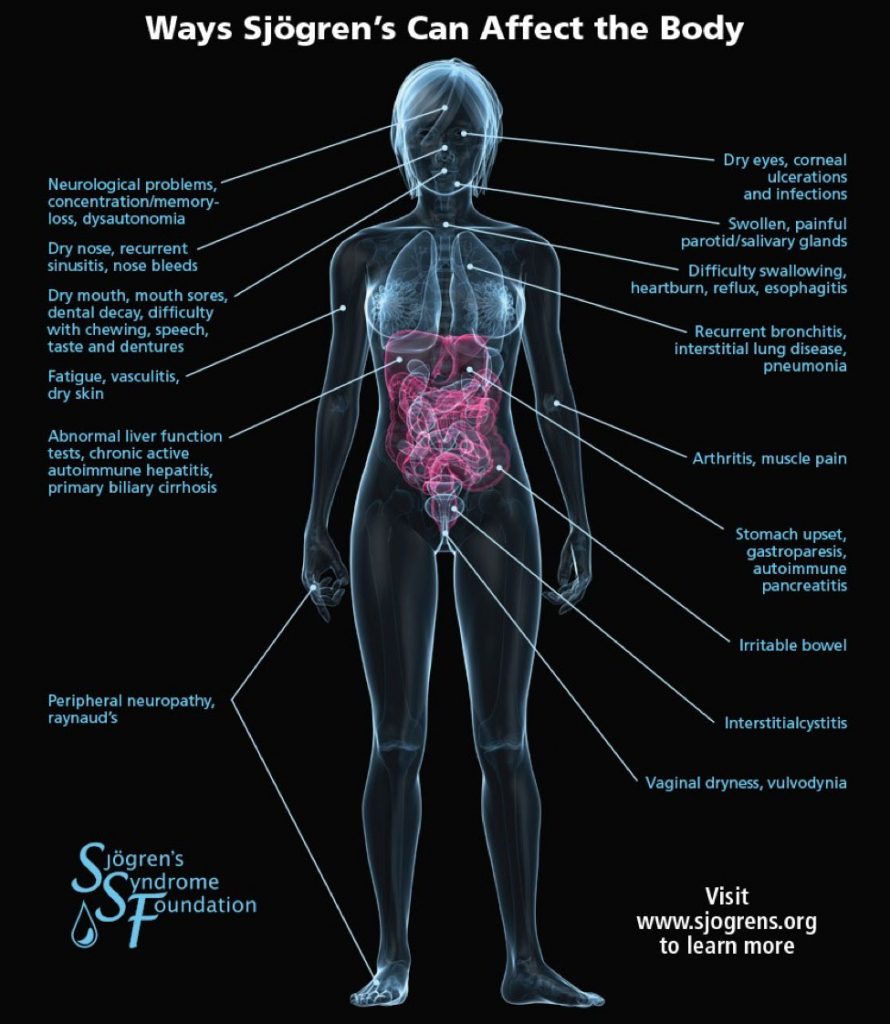

Since the coronavirus pandemic began, we have seen an increase in COVID-19 long haulers who are now debilitated by COVID-induced POTS or Nervous system disorders. We have been appealing Long Term Disability Insurance denials for clients suffering from POTS (Postural orthostatic tachycardia syndrome) and other Nervous System Disorders for many years. And we have found …